Guide to Stock Picking Strategies Passed Down from Benjamin Graham and Warren Buffett

Benjamin Graham and Warren Buffett are widely regarded as two of the greatest investors of all time. Their stock picking philosophies and strategies have helped them generate incredible wealth over the years. In this guide, we will explore some of the key stock picking strategies passed down from these two investing giants.

Benjamin Graham's Value Investing Approach

Benjamin Graham was known for his value investing approach. This approach involves buying stocks that are trading below their intrinsic value. Graham believed that stocks that are trading at a discount to their intrinsic value have the potential for long-term growth.

4.1 out of 5

| Language | : | English |

| File size | : | 455 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |

To determine the intrinsic value of a stock, Graham used a variety of factors, including the company's earnings, dividends, and assets. He also looked for companies with strong management teams and sustainable competitive advantages.

Key Principles of Graham's Value Investing Approach:

- Buy stocks that are trading at a discount to their intrinsic value.

- Focus on companies with strong fundamentals, such as earnings, dividends, and assets.

- Look for companies with strong management teams and competitive advantages.

Warren Buffett's Value Investing Approach

Warren Buffett also follows a value investing approach, but he has a slightly different interpretation of it than Graham did. Buffett believes that the intrinsic value of a stock is based on the company's future earning potential.

To determine the future earning potential of a company, Buffett looks for companies with strong competitive advantages, sustainable business models, and a track record of profitability. He also considers the company's management team and corporate culture.

Key Principles of Buffett's Value Investing Approach:

- Buy stocks of companies with strong competitive advantages.

- Focus on companies with sustainable business models and a track record of profitability.

- Consider the company's management team and corporate culture.

Key Stock Picking Strategies Passed Down from Graham and Buffett

Here are some of the key stock picking strategies that Graham and Buffett have passed down to investors:

- Invest in companies with strong fundamentals. This means investing in companies with strong earnings, dividends, and assets. It also means investing in companies with strong management teams and sustainable competitive advantages.

- Buy stocks at a discount to their intrinsic value. This means buying stocks that are trading below their estimated future earning potential. To determine the intrinsic value of a stock, you can use a variety of factors, such as the company's earnings, dividends, assets, and competitive advantages.

- Have a long-term investment horizon. Graham and Buffett both believed in investing for the long term. They believed that the stock market is a volatile place in the short term, but that over the long term, the stock market has a tendency to trend upwards.

- Be disciplined. Investing is not always easy. There will be times when you will be tempted to sell your stocks when the market is going down. However, it is important to stay disciplined and stick to your investment plan.

Benjamin Graham and Warren Buffett are two of the most successful investors of all time. Their stock picking strategies have helped them generate incredible wealth over the years. By following these strategies, you can improve your chances of success as an investor.

4.1 out of 5

| Language | : | English |

| File size | : | 455 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Octavia E Butler

Octavia E Butler Siim Land

Siim Land Gennarose Nethercott

Gennarose Nethercott Suzanne Collins

Suzanne Collins Alexander Neubauer

Alexander Neubauer Dorothy Dunnett

Dorothy Dunnett Brian Van Brunt

Brian Van Brunt Paulo Freire

Paulo Freire Robert D Blackwill

Robert D Blackwill Steven J Zaloga

Steven J Zaloga Stephanie Ellis

Stephanie Ellis Terry Spring

Terry Spring Roberta Edwards

Roberta Edwards Whitney Collins

Whitney Collins Lisa M Schab

Lisa M Schab Wolff Michael Roth

Wolff Michael Roth Demetria Clark

Demetria Clark Rae Snape

Rae Snape Oman Sukmana

Oman Sukmana Kellie Coates Gilbert

Kellie Coates Gilbert

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Douglas PowellUnveiling the Twelve Powers of the Soul: A Journey into the Depths of Human...

Douglas PowellUnveiling the Twelve Powers of the Soul: A Journey into the Depths of Human...

Arthur MasonAn Administrative Perspective On Prevention Of Gun Violence: A Comprehensive...

Arthur MasonAn Administrative Perspective On Prevention Of Gun Violence: A Comprehensive...

Truman CapoteThe Trials of Harry Truman: A Presidency Tested by Cold War, Corruption, and...

Truman CapoteThe Trials of Harry Truman: A Presidency Tested by Cold War, Corruption, and...

Michael SimmonsThe Poetical Works of Alexander Pope Vol. 2: A Literary Journey through...

Michael SimmonsThe Poetical Works of Alexander Pope Vol. 2: A Literary Journey through... Chuck MitchellFollow ·6.9k

Chuck MitchellFollow ·6.9k Vernon BlairFollow ·10.6k

Vernon BlairFollow ·10.6k Jan MitchellFollow ·11.8k

Jan MitchellFollow ·11.8k Brandon CoxFollow ·7.6k

Brandon CoxFollow ·7.6k Spencer PowellFollow ·8.9k

Spencer PowellFollow ·8.9k Edward BellFollow ·10.4k

Edward BellFollow ·10.4k David BaldacciFollow ·3.5k

David BaldacciFollow ·3.5k Greg FosterFollow ·13.2k

Greg FosterFollow ·13.2k

Leslie Carter

Leslie CarterWhat We Must Do Now To Save Reproductive Freedom

Roe v. Wade, the landmark...

Cade Simmons

Cade SimmonsThe Unbreakable Bond: Unveiling the Connection Between...

In the realm of...

Roy Bell

Roy BellFull Contact Chapter Five: The Final Chapter of the Hatch...

In this gripping to the Hatch saga, we...

Fred Foster

Fred FosterUnveiling the Tale of the Genpei Wars: A Comprehensive...

Deep within the annals of Japanese history,...

Jaden Cox

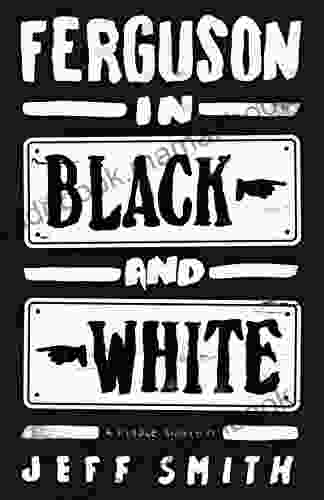

Jaden CoxFerguson in Black and White: A Profound Examination of...

The Ferguson tragedy, sparked by the fatal...

4.1 out of 5

| Language | : | English |

| File size | : | 455 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 13 pages |

| Lending | : | Enabled |